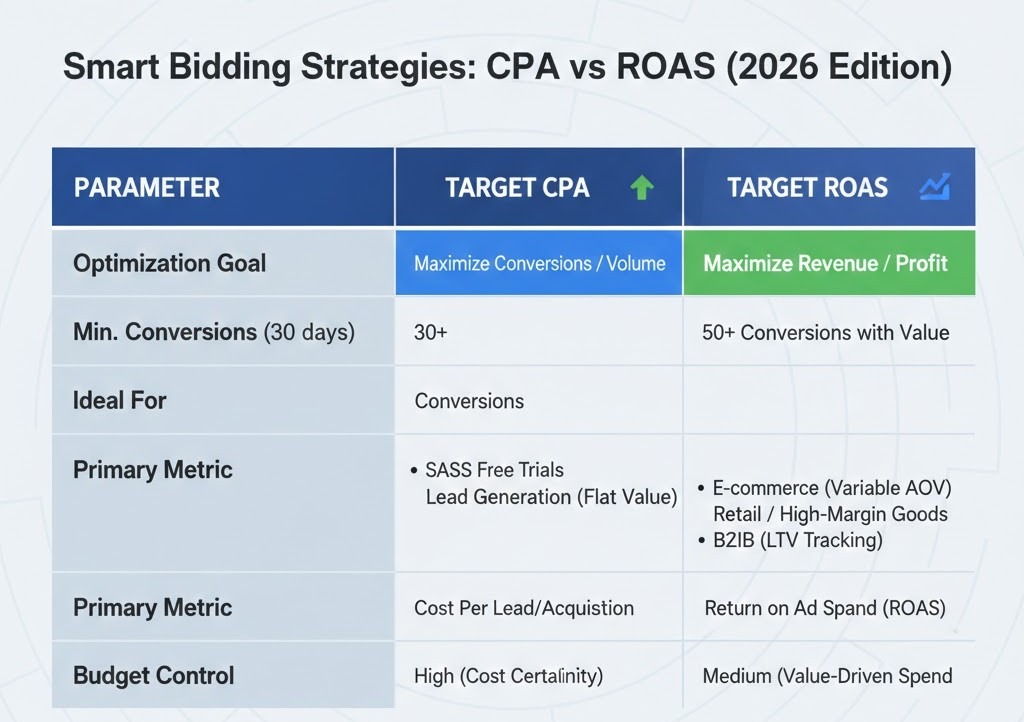

Target ROAS vs Target CPA

Introduction

If you’ve been managing Google Ads campaigns in the US lately, you know that 2026 has brought a new level of "pay-to-play" intensity. We aren't just fighting over keywords anymore; we are fighting over signals. With the full integration of privacy-first tracking and the maturity of Google’s AI, the days of manual "bid-to-position" strategies feel like ancient history. Today, the real battle happens at the bidding strategy level. Most advertisers eventually find themselves at a crossroads: target ROAS vs target CPA. This choice defines how Google’s algorithm treats your budget and, ultimately, whether your business actually grows or just generates "vanity" metrics.

Let’s be honest: Google wants you to spend. But as a business owner or a lead-gen specialist, you want to invest. The target ROAS vs target CPA Google Ads debate isn't about which button is "magic"—it’s about which one matches your math. I’ve seen accounts in the home services niche spend $400 for a lead that’s only worth $100 because they were using the wrong bidding logic. On the flip side, I've seen e-commerce brands miss out on millions in revenue because they were too focused on a flat CPA rather than the actual value of a shopping cart.

In this guide, we are going to tear these two strategies apart to see what makes them tick. Whether you are a small business owner trying to survive or a high-volume US advertiser looking for that extra 2% efficiency, knowing when to use target ROAS vs target CPA is non-negotiable. We will look at formulas, real-world frameworks, and the messy "learning phases" that everyone hates but nobody can avoid.

How target CPA works

Target CPA (tCPA) is effectively the "Old Faithful" of smart bidding. It is a strategy built on the idea of a flat acquisition cost. If you know exactly what a lead or a sale is worth to you, and that value doesn't change much from one customer to the next, tCPA is your best friend. In the 2026 US market, where competition is fierce, tCPA acts as a ceiling that prevents the algorithm from going totally rogue with your budget.

Definition and basic formula

At its core, target CPA is an automated bidding strategy that sets bids to get as many conversions as possible at or below the specific cost-per-action you’ve set. It doesn’t look at the revenue a user might bring in; it only cares about the binary event—did they convert, or did they not? The algorithm uses historical data and real-time signals like location, time of day, and browser type to predict the likelihood of a conversion.

The formula is straightforward, though Google’s backend math is obviously more complex. You can think of it in these terms:

Actual CPA = Total Ad Spend / Total Number of Conversions

When you set a target, you are telling Google your desired average. This means some conversions will cost $10 and others $30, but the system will aim to keep the average at your $20 target over time.

When the target CPA is a good fit

This strategy is the "bread and butter" for businesses where every conversion is essentially equal. If you are running a plumbing business in Chicago and every "Request a Quote" form is worth roughly the same to you, you don't need to complicate things with revenue tracking. You just need a steady stream of calls at a price that leaves you with a profit margin. It is also excellent for brand awareness campaigns where the "action" is a newsletter sign-up or a whitepaper download.

We typically recommend this strategy in the following scenarios:

-

Lead generation businesses where the goal is a simple form fill or a phone call.

-

Subscription services with a flat monthly fee where every new user brings the same initial value.

-

New accounts that have enough conversion data to be stable but haven't yet mastered "Value-Based Bidding" or revenue tracking.

-

SaaS companies targeting a specific "Free Trial" sign-up as their primary conversion goal.

In these cases, trying to assign a "value" to a conversion can actually confuse the algorithm. If you have a binary goal, stay binary. This is a common realization when trying to choose between target ROAS and target CPA during the early stages of a campaign.

Pros and cons of target CPA

Like any tool, tCPA has its sharp edges. The biggest "pro" is predictability. If your business model relies on a strict "Cost of Goods Sold" (COGS) calculation, tCPA allows you to scale while knowing your margins are protected. It is also much easier to set up because you don't need to pass complex price data from your website back to Google Ads. You just need a working conversion pixel.

However, the downsides are real, especially in 2026. Because tCPA treats every user the same, it can lead to "low-quality" conversions. If the algorithm finds a pool of users who are very likely to fill out a form but very unlikely to actually buy your premium service, it will spend your entire budget there because they are "cheap."

The trade-offs generally look like this:

-

It provides high control over the total volume of leads within a specific budget.

-

It simplifies the reporting process for stakeholders who only care about the cost-per-lead.

-

It can potentially ignore high-value users because their "predicted cost" exceeds your target bid.

-

It may struggle in markets with high seasonality where the "going rate" for a click fluctuates wildly.

When looking at the pros and cons of target CPA, you have to ask yourself if you are willing to lose a $1,000 customer because their acquisition cost was $5 over your limit. For many, that's a deal-breaker.

How target ROAS works

If target CPA is the strategy for those who want to control costs, target ROAS (tROAS) is the strategy for those who want to maximize their bottom line. In 2026, we’ve moved beyond simple revenue tracking. Advertisers are now feeding high-level data like gross profit and predicted Customer Lifetime Value (LTV) back into the system. With tROAS, you aren't telling Google "get me a customer for $50"; you’re saying "for every $1 I give you, I need $5 back in value." This shift transforms your ad spend from a simple expense into a dynamic investment vehicle.

Definition and basic formula

Target ROAS stands for Target Return on Ad Spend. It’s a smart bidding strategy that uses Google’s AI to predict the potential value of a user in the millisecond before an auction happens. Unlike tCPA, which is binary (converted vs. not converted), tROAS is weighted. If the algorithm sees a user who is likely to fill a $500 shopping cart, it will bid significantly higher for that person than for someone likely to only buy a $20 accessory.

The standard formula for calculating your current ROAS is:

ROAS = Total Conversion Value / Total Ad Spend x 100%

For example, if a boutique apparel brand in Los Angeles spends $1,000 on a Performance Max campaign and generates $5,000 in sales, their ROAS is 500%. When you set a 500% target, Google’s machine learning attempts to find a mix of high-value and low-value conversions that average out to that specific return. It is essentially the more sophisticated cousin of the target ROAS vs maximize conversion value debate, where the latter just tries to get as much value as possible without a specific efficiency constraint.

When target ROAS is a good fit

This strategy is almost mandatory for e-commerce stores with varied product price points. If you sell everything from $10 phone cases to $1,200 smartphones, a flat CPA target would be disastrous. You’d overpay for the cheap items and never bid high enough to win the expensive ones. In 2026, we are also seeing more B2B companies adopt tROAS by assigning different values to lead stages—for example, a "Newsletter Signup" is worth $5, while a "Book a Demo" is worth $500.

Expert practitioners generally find that tROAS is the optimal choice when:

-

You have a clear, reliable way to pass conversion value back to Google Ads (server-side tracking is the gold standard here).

-

Your product catalog has a wide range of prices and margins.

-

You have achieved a stable volume of data, typically at least 50 conversions with value over the last 30 days.

-

You want to prioritize profit over raw conversion volume.

One notable case study from late 2025 involved 1STOPlighting, a major US-based lighting and home decor retailer. When they transitioned their Shopping campaigns from a focus on cost-per-acquisition to a target ROAS strategy, they saw a 214% increase in total profit. Another high-end example is Joybird, the custom furniture brand, which utilized Google’s value-based Smart Bidding (specifically within Performance Max) to achieve a 40% higher ROAS and a 95% lift in revenue by focusing on their high-margin, customizable sectionals rather than low-ticket accessories.

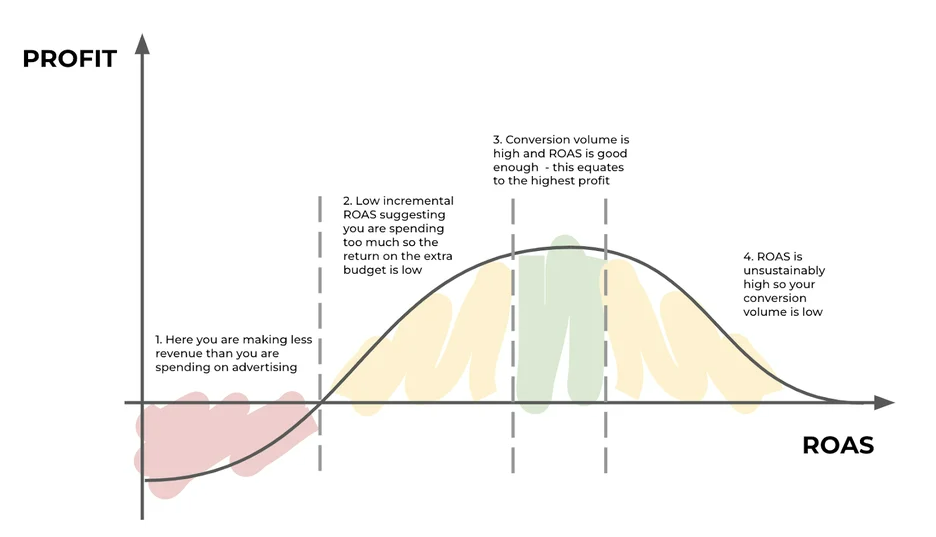

Pros and cons of target ROAS

The primary benefit of tROAS is that it aligns your advertising directly with your financial goals. It forces the algorithm to be "money-smart" rather than just "conversion-hungry." This is why many US-based retailers have moved away from volume-based bidding. However, this precision comes with complexity. The biggest "con" is that tROAS is incredibly sensitive to tracking errors. If your conversion values stop firing for even a day, the bidding strategy can go into a tailspin, as it suddenly "thinks" your traffic is worthless.

When weighing the pros and cons of target ROAS, consider these points:

-

It naturally optimizes for higher Average Order Value (AOV) and helps scale high-margin products.

-

It allows for flexible budget allocation—the system can spend more when high-value opportunities are detected.

-

It requires a much higher data threshold than the target CPA to function effectively without wild fluctuations.

-

It can be "stiff"; if you set your target too high, the algorithm may stop bidding entirely to protect the efficiency, causing your traffic to fall off a cliff.

A common mistake is setting a recommended starting target ROAS 2026 level—which was often around 300% to 400% for many retail niches—without accounting for the increased CPCs we are seeing now. If your margins are thin, tROAS can be a lifesaver, but only if you are willing to babysit the data quality.

Key differences between target ROAS and target CPA

Understanding the difference between these two isn't just about math; it's about the "intent" you are signaling to the AI. If you choose a target CPA, you are essentially telling Google, "I am price-sensitive." If you choose target ROAS, you are saying, "I am margin-sensitive." In the 2026 US landscape, where the cost of a single click can fluctuate by 300% based on the time of day, this distinction is everything.

Optimization goal and required data

The target CPA is a volume-first strategy. It treats every conversion as a binary 1 or 0. The algorithm doesn't care if the user is about to buy a $5,000 diamond ring or a $50 silver cleaning kit; it only cares about the probability of any conversion occurring. This makes it much less data-hungry. You can generally find stability with tCPA once you hit about 30 conversions in a 30-day window.

Target ROAS , however, is a value-first strategy. It requires not just the "fact" of the conversion, but the "weight" of it. To make this work, the algorithm needs to see the revenue associated with each click. This is why tROAS requires a higher data threshold—usually a minimum of 50 conversions with value in the last month—to avoid what we call "signal noise." Without enough data, a single high-value purchase can cause the AI to over-bid on similar profiles that may never actually convert again.

Impact on volume, CPC and revenue

This is where things get interesting for your daily management.

Target CPA often leads to higher conversion volumes. Because the algorithm is looking for the "cheapest" path to a lead, it will scoop up a lot of low-hanging fruit. However, your Average Order Value (AOV) will likely remain flat or even dip, as the system isn't incentivized to find big spenders.

Target ROAS often results in lower total conversion volume but higher total revenue. The system will intentionally skip "cheap" auctions if it predicts the user won't spend much. Consequently, you will notice your CPCs actually increase with tROAS. Why? Because you are bidding more aggressively for the "whales" who are likely to spend big.

Examples for e-commerce and lead generation

Let’s look at two distinct US business models to see the target ROAS vs target CPA difference in action:

Case A: The E-commerce Boutique (The "Article" Model) Imagine a furniture brand like Article selling $2,000 sofas and $40 cushions.

-

Target CPA: If set at $50, Google will happily get you 100 cushion sales. You spent $5,000 to make $4,000. You are out of business.

-

Target ROAS: If set at 500%, Google will ignore the cushion-only shoppers and spend the budget on people searching for "mid-century leather sectionals." You might only get 10 sales, but at $2,000 each, you’ve made $20,000 on a $4,000 spend.

Case B: Lead Generation (The SaaS or Legal Model) Consider a US-based law firm specializing in personal injury.

-

Target CPA: This is usually the winner here. Every "Free Consultation" form is roughly the same value at the top of the funnel. By using a target CPA for lead gen, the firm can maintain a steady flow of inquiries at a predictable $150 per lead.

-

Target ROAS: This only works here if the firm uses Offline Conversion Tracking (OCT) to feed the settlement value back to Google. If they can tell Google that "Lead A" turned into a $50,000 case while "Lead B" was a $500 case, then tROAS becomes a superpower.

Tracking traffic and prerequisites

Before you even think about hitting the switch to target ROAS bidding strategy guide territory, your house must be in order. In 2026, "basic" tracking is a recipe for failure. With the depreciation of third-party cookies in Chrome and the rise of privacy-safe browsing, Google’s AI is only as good as the "first-party" data you feed it.

Setting up conversion and value tracking in GA4 (Google Analytics 4)

To run a successful target ROAS vs target CPA Google Ads test, GA4 must be your source of truth. You need to ensure that "Purchase" events are firing with the value and currency parameters mapped correctly.

For US advertisers, the standard 2026 setup includes:

-

Enhanced Conversions: This is no longer optional. You must send hashed first-party data (email, phone) back to Google to "stitch" together journeys that cross devices or browsers.

-

Server-Side Tracking: Relying on browser-based tags is too risky. Moving your tracking to a server-side GTM container ensures that conversion values aren't blocked by ad-blockers or Safari’s ITP.

-

Value Rules: In GA4, you can now set rules to adjust values based on conditions. For example, if a user is from a high-income ZIP code in Manhattan, you can tell the system to "weight" that conversion 20% higher.

Handling lead quality, offline conversions and LTV

If you are in lead gen and want to switch from target CPA to target ROAS, you have to master Offline Conversion Imports (OCI). The biggest mistake we see in US accounts is treating a "form fill" as the end of the journey. In reality, about 60% of leads in industries like real estate or insurance are "junk."

To solve this, you need to:

-

Assign a Value to the Lead Stage: If a lead is worth $10, a "Qualified Lead" is worth $100, and a "Closed Deal" is worth $1,000.

-

Upload the Data: Use a tool like Zapier or a direct CRM integration (Salesforce/HubSpot) to push these status changes back to Google Ads within 90 days of the original click.

-

Optimize for the Deep Funnel: Once you have this data, you can set a target ROAS based on the actual revenue generated by those leads, not just the fact that they filled out a form.

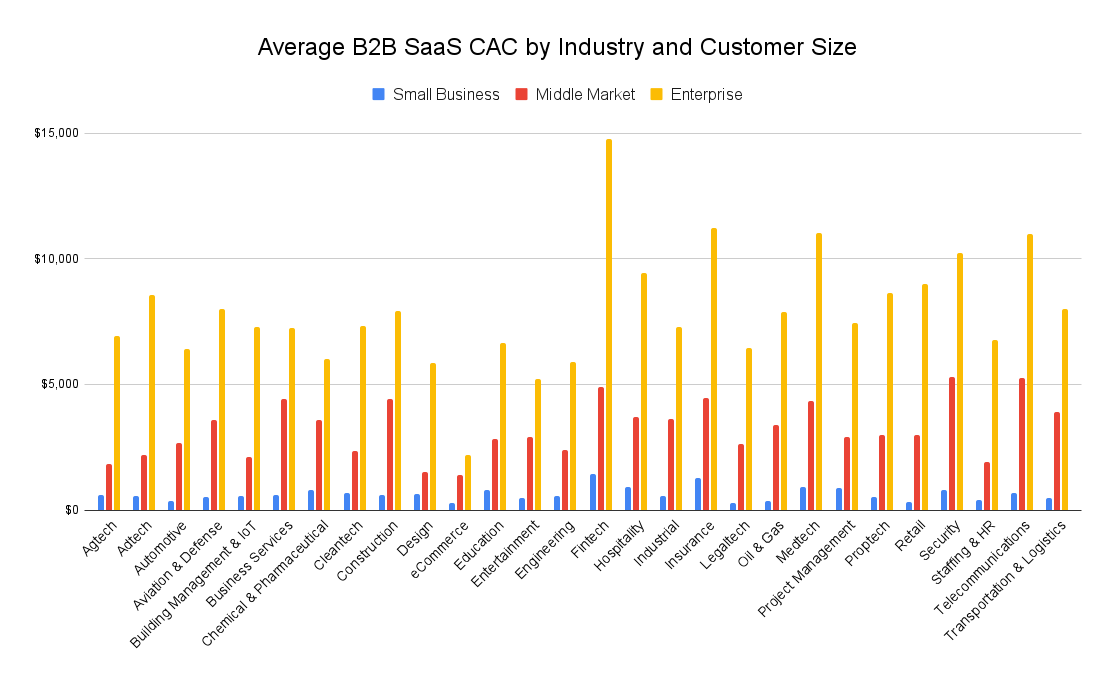

A 2025 study of US B2B SaaS firms showed that those who optimized for "Qualified Lead Value" rather than "Raw Lead CPA" saw a 14% lower Customer Acquisition Cost (CAC) because the AI learned to stop bidding on "bot-like" behavior that never progressed past the first form.

Choosing the right strategy for your business model

When you decide to choose between target ROAS and target CPA, you need to look at your inventory and your sales cycle. In the 2026 US market, where consumer behavior is fragmented across multiple touchpoints, your bidding strategy acts as the "filter" for the traffic you actually want to buy. We always tell our clients to look at their "spread" of transaction values. If your lowest-priced item and your highest-priced item are within 20% of each other, CPA is fine. But if you have a wide range, you’re leaving money on the table by not using value-based bidding.

Framework for e-commerce advertisers

For e-commerce, the decision is almost always tilted toward ROAS. The reality of target ROAS vs target CPA for ecommerce is that products have different margins. If you’re a brand like Nike, selling a $20 pair of socks and a $250 pair of limited-edition sneakers, a flat CPA target would force the algorithm to treat both sales as equal. This leads to the "cheap conversion trap" where the AI spends your budget on the low-ticket items because they are easier to convert, effectively ignoring your high-margin revenue drivers.

To build a solid framework for e-commerce, you should consider the following variables:

-

Variable Product Margins: Use tROAS if your margins vary significantly across your catalog, allowing the system to bid more for high-margin sales.

-

Return Rate and Net Profit: Feed "Net Revenue" data (after returns) back into Google Ads to ensure the ROAS target is optimizing for money you actually keep.

-

Customer Acquisition vs. Retention: Set different ROAS targets for "New Customer" campaigns versus "Remarketing" to account for the higher cost of initial acquisition.

-

Inventory Turnover: Use lower ROAS targets for clearance items where the goal is liquidity rather than maximum profit per unit.

A great example of this is Allbirds. They’ve moved toward a highly segmented tROAS approach where they value "First-Time Buyers" at a higher rate than repeat purchasers within their smart bidding signals. By doing this, they’ve managed to grow their customer base in the US while maintaining an efficient overall return on spend.

Framework for lead generation and B2B

In the world of target ROAS vs target CPA for lead gen, the conversation is a bit different. For a long time, CPA was the undisputed king because a lead was just a lead. However, in 2026, we’ve seen a massive shift toward "Quality-Adjusted Bidding." If you’re a US-based SaaS company like Slack or Zoom, a lead from a Fortune 500 company is worth 100x more than a lead from a student. If you use a flat CPA, Google will bring you 1,000 students because they are "cheap," and your sales team will hate you.

The framework for high-level lead generation typically involves these steps:

-

Defined Conversion Stages: Map out your funnel from "MQL" (Marketing Qualified Lead) to "Closed-Won" and assign a dollar value to each milestone.

-

Integration with CRM: Ensure your Salesforce or HubSpot data flows back to Google so the AI can see which keywords actually lead to revenue.

-

Volume vs. Quality Balance: Start with tCPA to get the volume flowing, then pivot to tROAS once you have enough "Closed-Won" data to signal value.

-

Geography-Based Weighting: Assign higher values to leads from specific US regions or industries that traditionally have a higher lifetime value.

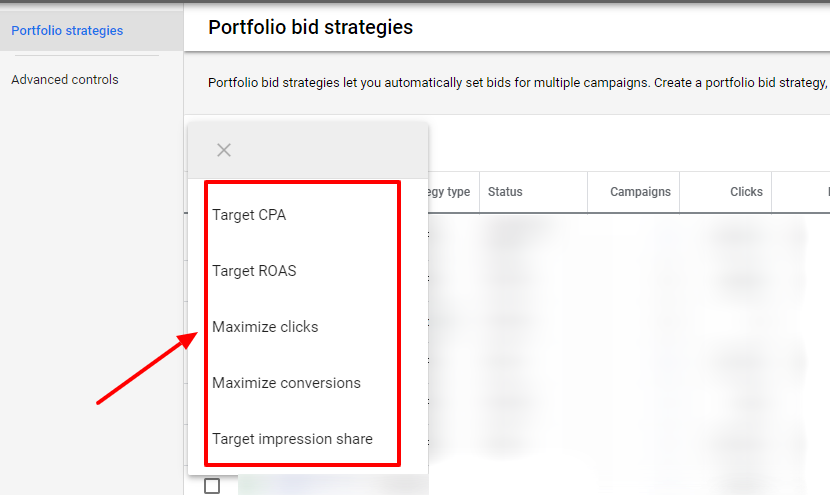

Setting up target CPA step-by-step

If you’ve decided that tCPA is the right move—perhaps you're a local service business or you're launching a new product with a flat price—the setup process is critical. You can't just "guess" a number. In the current 2026 landscape, the recommended starting target CPA 2026 figures are usually 10-20% higher than your actual historical average to give the algorithm room to breathe during the learning phase.

Campaign and portfolio level configuration

The first choice you face is whether to set your target at the individual campaign level or use a Portfolio Bid Strategy. For most US advertisers managing multiple campaigns with similar goals, the Portfolio approach is the winner. It allows the algorithm to "share" data across campaigns, which is a lifesaver if you have a few low-volume campaigns that struggle to hit the 30-conversion-per-month threshold on their own.

When configuring your setup, keep these tactical points in mind:

-

Group by Goal: Only put campaigns with the same target CPA into a single portfolio to avoid "averaging" your way into a loss.

-

Shared Budgets: Consider using a shared budget with your portfolio strategy to allow the AI to move money to the best-performing campaign in real-time.

-

Bid Ceilings and Floors: Use these sparingly; setting a Max CPC limit can prevent the AI from winning high-quality auctions during peak times.

-

Location Targets: Ensure your tCPA campaigns are geofenced correctly, as a $50 CPA in New York might be a steal, but in rural Ohio, it could be a massive overpay.

By using a portfolio strategy, you’re essentially giving the AI a larger "brain" to work with.

Recommended starting targets and bid limits

A common mistake is being too aggressive right out of the gate. If your historical CPA is $40, and you set your target CPA at $30, the algorithm will likely "choke." It will see that it can't win auctions at that price and will simply stop spending your budget. For the target CPA bidding strategy guide, we always insist on starting where you actually are, not where you want to be.

Here is a simple logic for setting your initial targets:

-

Use the 30-Day Average: Look at your actual CPA over the last month and set that as your initial target.

-

Factor in Seasonal Flux: If you are launching in November in the US, add a 25% buffer to your target to account for the massive spike in auction competition.

-

Avoid Max CPC Limits Initially: Let the system bid what it needs to for the first 14 days to see what the "true" market price is.

-

Adjust in Small Increments: Never change your target by more than 10% at a time, and wait at least a week between adjustments.

Think of it like training a horse. You don't ask it to jump a six-foot fence on day one. You start with the height it’s comfortable with and slowly raise the bar as it gets more confident (or in this case, as the AI gets more data).

Monitoring the learning phase and stabilization

Once you hit "save," you enter the "Learning Phase." In 2026, this usually lasts between 7 and 14 days. During this time, your performance will likely look like a roller coaster. You’ll have a day with a $10 CPA followed by a day with a $200 CPA. The worst thing you can do is panic and change the settings. Every time you change a target during the learning phase, you reset the clock.

To survive this period without losing your mind, follow these rules:

-

Check the "Bid Strategy Status" Tab: Google will literally tell you if it's "Learning," "Limited," or "Misconfigured."

-

Ignore Daily Fluctuations: Look at 7-day rolling averages rather than day-to-day data to see the true trend.

-

Watch Your Impression Share: If your "Impression Share Lost due to Rank" starts climbing, your target is likely too low.

-

Monitor Lead Quality: Sometimes the CPA looks great, but the leads are coming from "Search Partners" or low-intent placements that don't convert into sales.

Optimization tactics and best practices

Mastering target ROAS vs target CPA Google Ads setups isn't just about the settings; it's about the environment you build around the AI. As Navah Hopkins, a top-ranked PPC expert and Senior Strategy Officer at Optmyzr, often says: "Smart bidding needs guardrails, not just goals. The AI is a powerful engine, but you are still the driver holding the map." In 2026, those guardrails consist of your account structure, your negative keyword lists, and your audience signals.

Structuring campaigns and budgets for smart bidding

The "Hagakure" or "Modern Search" structure is the standard for 2026. This means moving away from dozens of tiny, granular campaigns and toward large, consolidated "data buckets." Smart bidding thrives on volume. If you split your budget across 20 campaigns, none of them will have enough data to optimize effectively.

To give the AI the best environment, follow these best practices:

-

Consolidate Campaigns: Aim for at least 50 conversions per month per campaign to give the bidding algorithm enough "fuel" to make accurate predictions.

-

Use Unconstrained Budgets: If you are using tROAS or tCPA, your budget should ideally be 5-10x your target CPA to prevent the system from "throttling" during peak conversion hours.

-

Portfolio Strategies with Max Limits: Use a portfolio strategy to group similar products, but consider a "Max CPC" cap if you’re in a volatile niche where a single click could cost $200.

-

Match Type Evolution: In 2026, "Broad Match + Smart Bidding" is the power couple. The AI uses the broad match to find new intent signals and the smart bidding to decide if that intent is worth a high bid.

ServiceNow, the US-based enterprise software giant, undertook a massive account restructuring to better leverage Google’s AI. By consolidating over 100 granular, manually-managed campaigns into a simplified portfolio structure using target CPA and broad match, they reduced the time their team spent on manual bid adjustments by 70%. This shift allowed their media buyers to move away from "knob-turning" and focus on high-level strategy and creative testing, ultimately driving a significant increase in lead quality across their global markets.

Using audiences and negatives to improve signals

Even the smartest AI can’t read your mind. It doesn't know that you’ve stopped selling a certain brand or that a specific zip code in New York is currently under construction and can't receive deliveries. You have to feed this information into the system through audience signals and negative keyword lists.

To sharpen your bidding signals, focus on the following:

-

First-Party Audience Uploads: Regularly sync your CRM lists (customers, leads, churned users) to Google Ads to help the system "find more people like these" or "avoid people like these."

-

Dynamic Negative Lists: Maintain a list of "junk" terms that are technically related but have zero intent (e.g., "free," "jobs," "manual," "wikipedia").

-

Seasonal Negatives: If you are an e-commerce brand, exclude terms related to "returns" or "complaints" from your high-intent acquisition campaigns.

-

Placement Exclusions: For Performance Max and Display, aggressively exclude low-quality mobile apps and "made-for-ads" websites that inflate your CTR but never convert.

A great example is Peloton. During their peak growth in the US, they used heavy audience exclusion lists to ensure they weren't spending acquisition budget on people who already owned a bike. By telling the AI "don't bid on my current customers," they funneled every dollar into finding new subscribers, significantly improving their overall CAC.

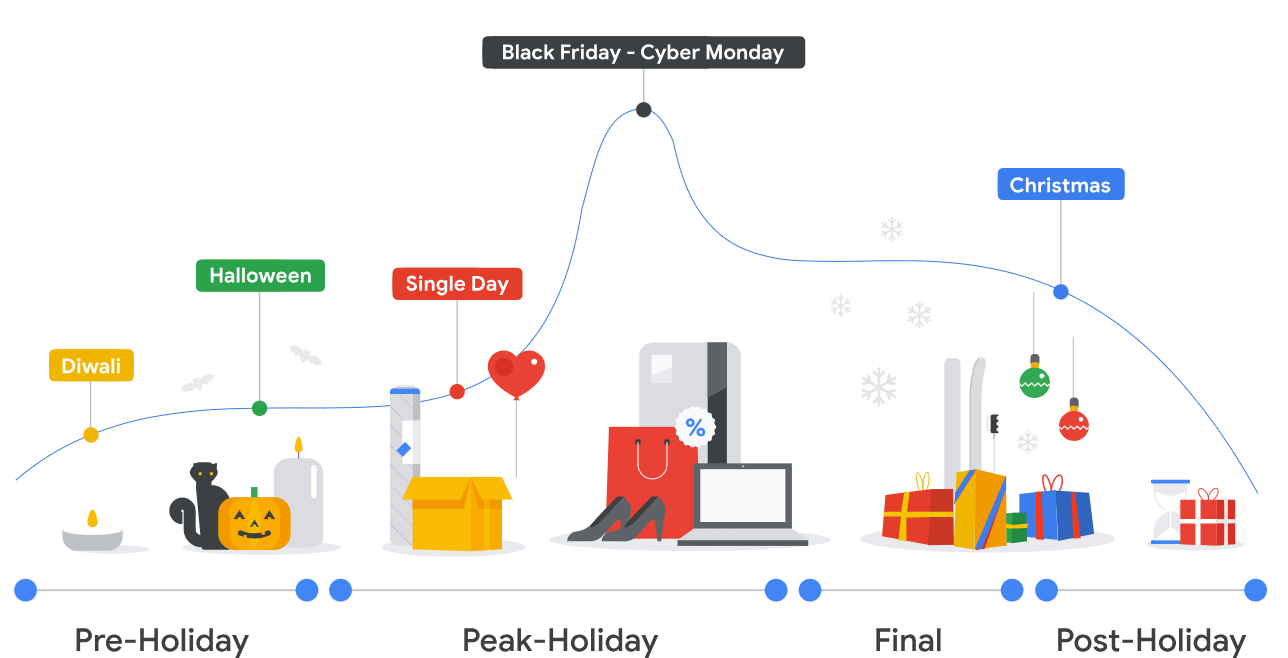

Seasonality, promotions, and bid adjustments

One of the biggest "gotchas" in smart bidding is how it handles sudden changes in the market. If you’re running a 48-hour flash sale with a 50% discount, your conversion rate will skyrocket. The AI will see this and think, "Wow, I’m a genius," and start bidding aggressively. But as soon as the sale ends, your conversion rate drops, and the AI is still bidding as if the sale is on, burning through your budget.

To manage these spikes, you should use:

-

Seasonality Adjustments: Tell Google 48 hours in advance that you expect a "conversion rate lift" of X% for a specific period. This prevents the AI from being "surprised" by the change.

-

Data Exclusions: If your site went down or you had a tracking glitch, use a data exclusion to tell the AI to "ignore" that specific period so it doesn't learn from broken data.

-

Promotional Ad Assets: Use "Promotion Extensions" to signal the deal to the user without changing the core "evergreen" ad copy that the AI has already optimized.

-

Budget Buffers: Increase your daily caps by 20-30% during major US holidays like Memorial Day or Labor Day to allow the system to capture the increased search volume.

Advanced strategies and combinations

Once you’ve mastered the basics of target ROAS vs target CPA Google Ads setups, the next step is "Portfolio Orchestration." In 2026, the most successful US advertisers don't just pick one strategy for the whole account; they mix and match based on the intent of the traffic. As Ginny Marvin, Google’s former Ads Liaison, has often noted, the goal of smart bidding is to find the right bid for every single auction, but you still need to segment your campaigns to reflect different business goals.

Mixing target ROAS and target CPA across the account

It is perfectly normal—and often recommended—to run a "hybrid" account. For example, Momentive (formerly SurveyMonkey) uses a mix of strategies to balance growth and efficiency. They might use target CPA for their high-volume, top-of-funnel lead generation (like "free survey templates") where the goal is simply to get a user into the ecosystem at a fixed cost. Simultaneously, they use target ROAS for their "Enterprise" and "Paid Plan" campaigns, where they can pass specific subscription values back to the system.

A common hybrid framework looks like this:

-

Brand Campaigns: Use target CPA to maintain a "dominance" at a low cost, ensuring you capture 100% of your own name searches.

-

Non-Brand Generic: Use target ROAS to ensure that when you bid on expensive terms like "best CRM software," you are only winning the auctions for users likely to choose a high-tier plan.

-

Remarketing: Use target CPA vs maximize conversions logic here. If a user has already visited your pricing page, you might just want to "Maximize Conversions" to close the deal regardless of the immediate ROAS, as the lifetime value is already secured.

Transitioning from manual bidding to smart bidding

If you are still on manual CPC in 2026, you are likely overpaying for 50% of your clicks and underbidding for the other 50%. However, you can’t just flip the switch overnight. When Autodesk moved their global search campaigns to a smart-bidding-first structure, they didn't do it in one click. They used a "phased rollout."

The transition path should follow this sequence:

-

Enhanced CPC (eCPC): Use this for 2 weeks to let the system "peek" at the auction signals while you still maintain control over the base bid.

-

Maximize Conversions: Switch to this for a "warm-up" period to let the AI see what a conversion looks like in the current market without a cost constraint.

-

Target CPA/ROAS: Once you have a stable "baseline" of what conversions cost, lock in your targets.

Using experiments to test strategies safely

The only way to definitively answer what is better target ROAS or target CPA for your specific account is to run a "Campaign Experiment." This allows you to split your traffic 50/50 between two strategies. For instance, Crate & Barrel famously used experiments to test target ROAS vs maximize conversion value during the holiday season. They found that while "Maximize Conversion Value" drove more revenue, "target ROAS " delivered 15% more net profit because it didn't chase the hyper-expensive, low-margin clicks during peak auction times.

Common mistakes

Even with the best intentions, it’s easy to break a smart bidding strategy. In the 2026 US market, where automation is the default, your biggest risks are "Bad Data" and "Impatience."

Under-reporting conversions and broken tracking

This is the silent killer. If your GTM container breaks or your server-side API skips a beat, the AI suddenly thinks your ads have stopped working. Because it’s trying to hit a target, it will lower its bids to "save money," which causes your traffic to tank. By the time you fix the tracking, the AI has already "learned" that your keywords are useless. Always use Conversion Value Rules and redundant tracking (GA4 + Ads Pixel) to ensure the signal never goes dark.

Setting targets too aggressively

If you’re a target ROAS vs target CPA for small business owner, you might be tempted to set a 1,000% ROAS or a $5 CPA to "guarantee" profit. This backfires. If the market rate for a conversion is $20, and you tell Google you only want to pay $5, the system won't "negotiate" for you—it will just stop showing your ads.

Expert Tip: Always look at your recommended starting target CPA 2026 data and add a 10% "wiggle room" margin. It is better to have a slightly less efficient campaign that is running than a "perfect" campaign that has zero impressions.

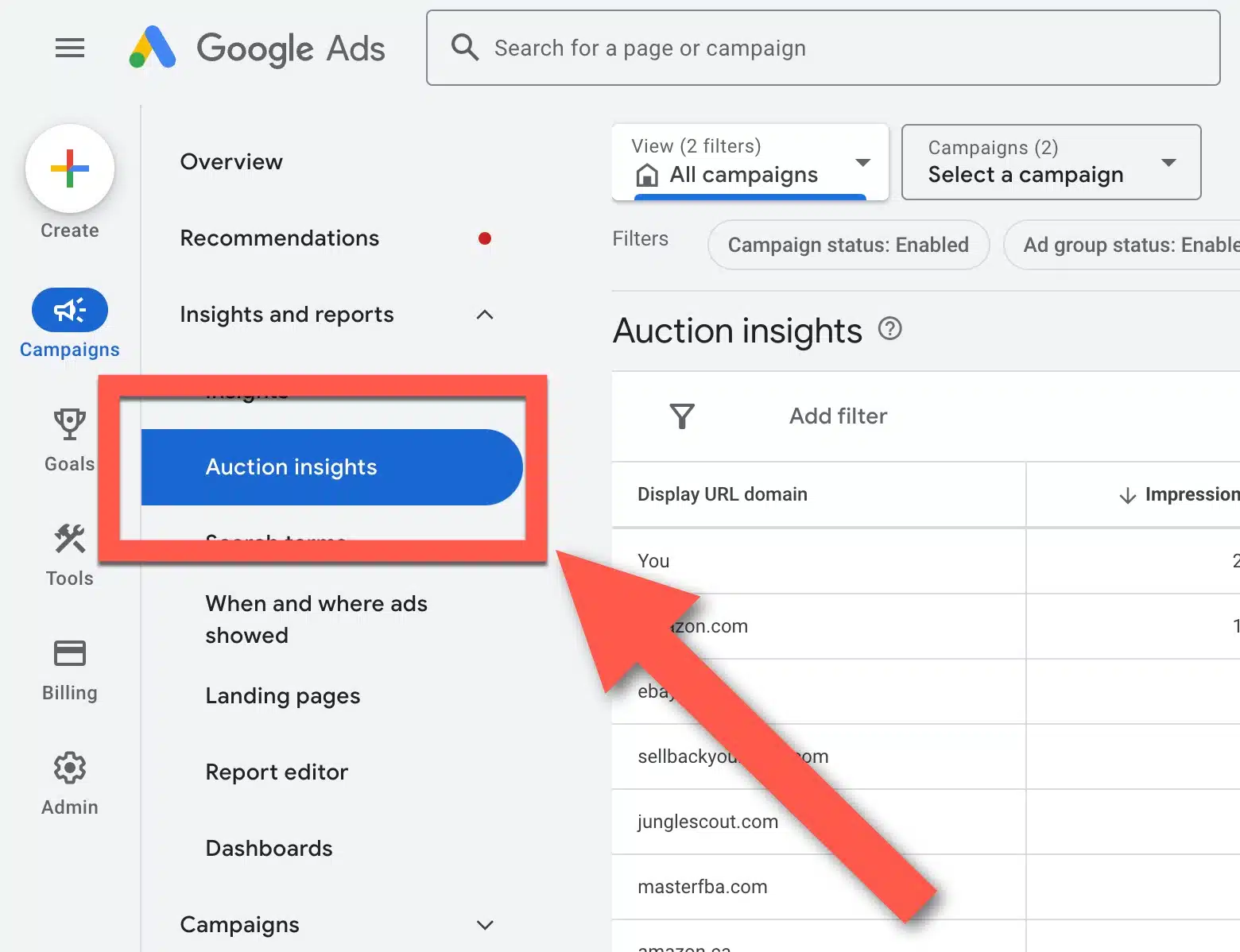

Diagnosing performance drops and volatility

When performance drops, don't immediately change the bid. First, check the "Auction Insights." Often, a drop in ROAS isn't an AI failure; it’s a new competitor in the US market bidding aggressively and driving up CPCs. If you lower your target during a competitive spike, you will lose all your visibility just when you need it most.

Conclusion

Deciding between target ROAS vs target CPA is no longer a matter of "set and forget." In 2026, it is the primary way you communicate your business's financial health to Google’s global auction machine.

For target ROAS vs target CPA for us advertisers, the path is clear:

-

Use target CPA if you are focused on volume, have a flat conversion value, or are a local service provider (like the HVAC and dental examples we discussed).

-

Use target ROAS if you are an e-commerce brand (like Allbirds or Nike), or a B2B firm with a complex, value-weighted funnel.

Remember the words of the experts: data is your fuel, but the bidding strategy is your steering wheel. Whether you are a small business looking for its first 50 conversions or a global enterprise like ServiceNow looking to save 70% of your management time, the "best" strategy is the one that allows you to scale without sacrificing your margins. Stop chasing clicks and start bidding for the outcomes that actually show up on your balance sheet.

FAQs

What is the difference between Target ROAS and Target CPA?

The core difference lies in what the AI is optimizing for: volume vs. value.

Target CPA (Cost Per Acquisition) focuses on getting as many conversions as possible at a specific cost, regardless of how much revenue each conversion generates. It treats every lead or sale as having equal value.

Target ROAS (Return on Ad Spend) focuses on revenue. It tells Google’s AI to prioritize users who are likely to spend more, aiming for a specific return on every dollar spent.

When should I use Target ROAS vs. Target CPA in Google Ads?

Use Target CPA if you are running a lead-generation business where all leads are roughly equal, or if you have a single-price product and your main goal is to control your cost per sale.

Use Target ROAS if you run an e-commerce store with varying price points or a B2B business that tracks "Lead Values." This allows the AI to bid higher for high-intent users and lower for bargain hunters.

Is Target ROAS better than Target CPA for ecommerce campaigns?

Almost always, yes. In e-commerce, a $20 sale and a $500 sale have very different impacts on your bottom line. Target CPA would treat them the same, potentially wasting your budget on low-value customers. Target ROAS ensures the algorithm pursues "high-basket" shoppers, which is essential for maintaining healthy profit margins.

How much data do I need before switching to Target ROAS or Target CPA?

Smart Bidding thrives on data signals. For the US market, where competition is high:

Target CPA: You should have at least 30 conversions in the last 30 days.

Target ROAS: You need more "math" for the AI to work with—ideally 50 conversions in the last 30 days with consistent conversion values reported.

Expert Tip: If you are below these numbers, start with "Maximize Conversions" to build a data baseline first.

How do I set the right Target ROAS or Target CPA for my US account?

Don't guess; look at your historical data.

For tCPA: Look at your average CPA over the last few weeks and set your target slightly above it to give the AI "room" to breathe during the learning phase.

For tROAS: Calculate your break-even ROAS (including COGS and shipping). Set your initial target at your recent historical average.

Warning: Setting a target that is too aggressive (e.g., asking for a 1000% ROAS when you’ve historically achieved 300%) will cause the algorithm to stop spending, as it won't find enough auctions that meet your impossible criteria.