Guide Prediction Markets Google Ads

Introduction

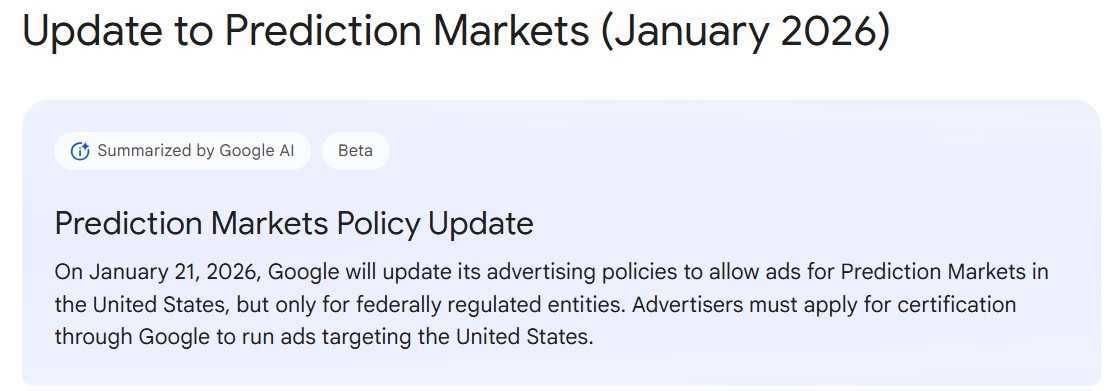

If you’ve been working in the high-stakes world of digital arbitrage or fintech marketing for a while, you know that "Prediction Markets" used to be a dirty phrase at Google. For years, trying to run an ad for anything resembling a binary outcome market was a one-way ticket to a permanent account suspension. We spent years dancing around "educational content" or "financial news" filters just to get a glimpse of the massive traffic searching for event-based betting. But as of the Google Ads policy Update January 2026, the walls have finally come down—at least for those who know how to navigate the new red tape.

The landscape has shifted from a total blockade to a highly regulated, "verification-first" model. Google is finally acknowledging these platforms as legitimate sources of sentiment analysis, moving beyond the old 'gambling' labels. If you are looking to scale a platform in this space, this Guide Prediction Markets Google Ads will be your roadmap through the certification process and the creative guardrails that now define the industry.

Policy shift overview

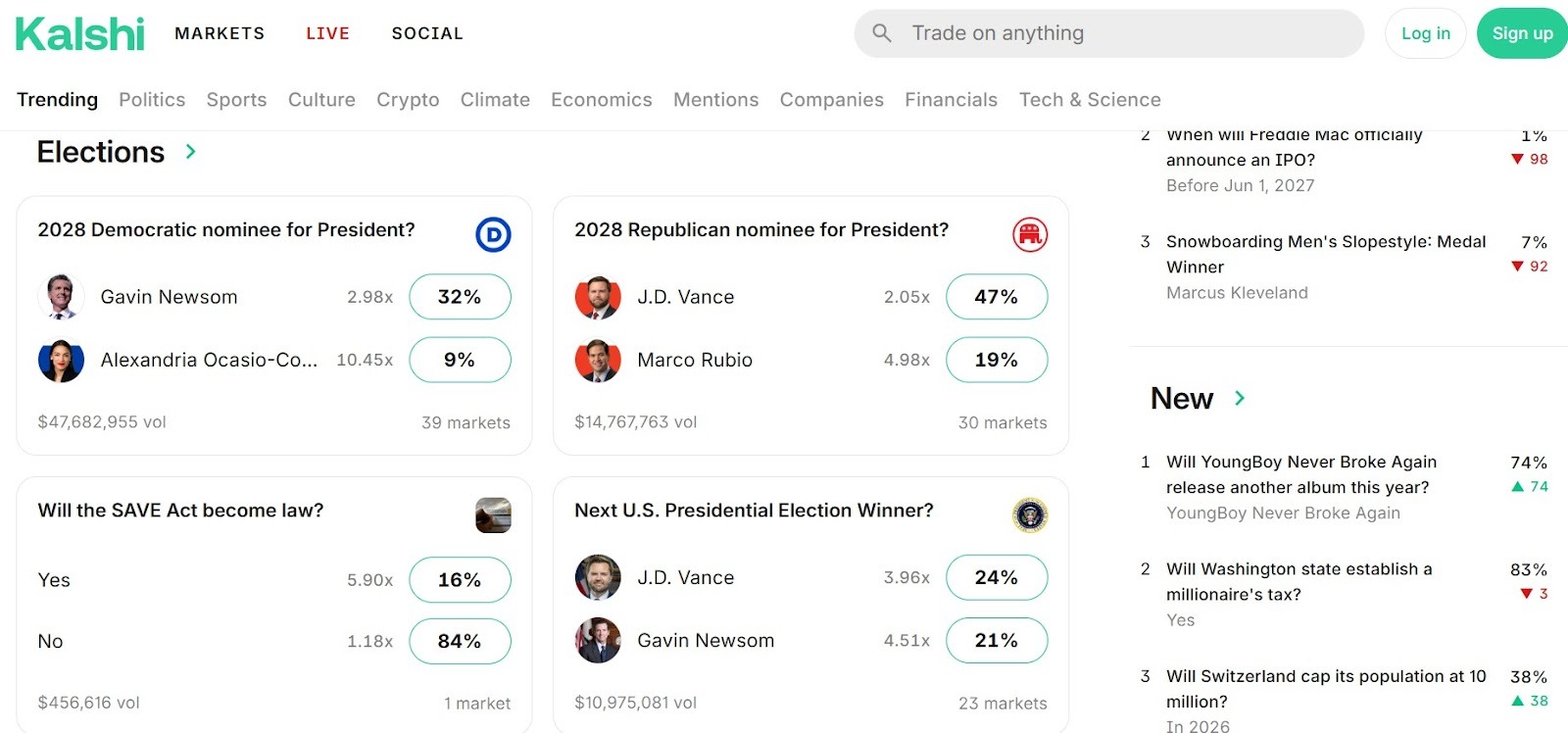

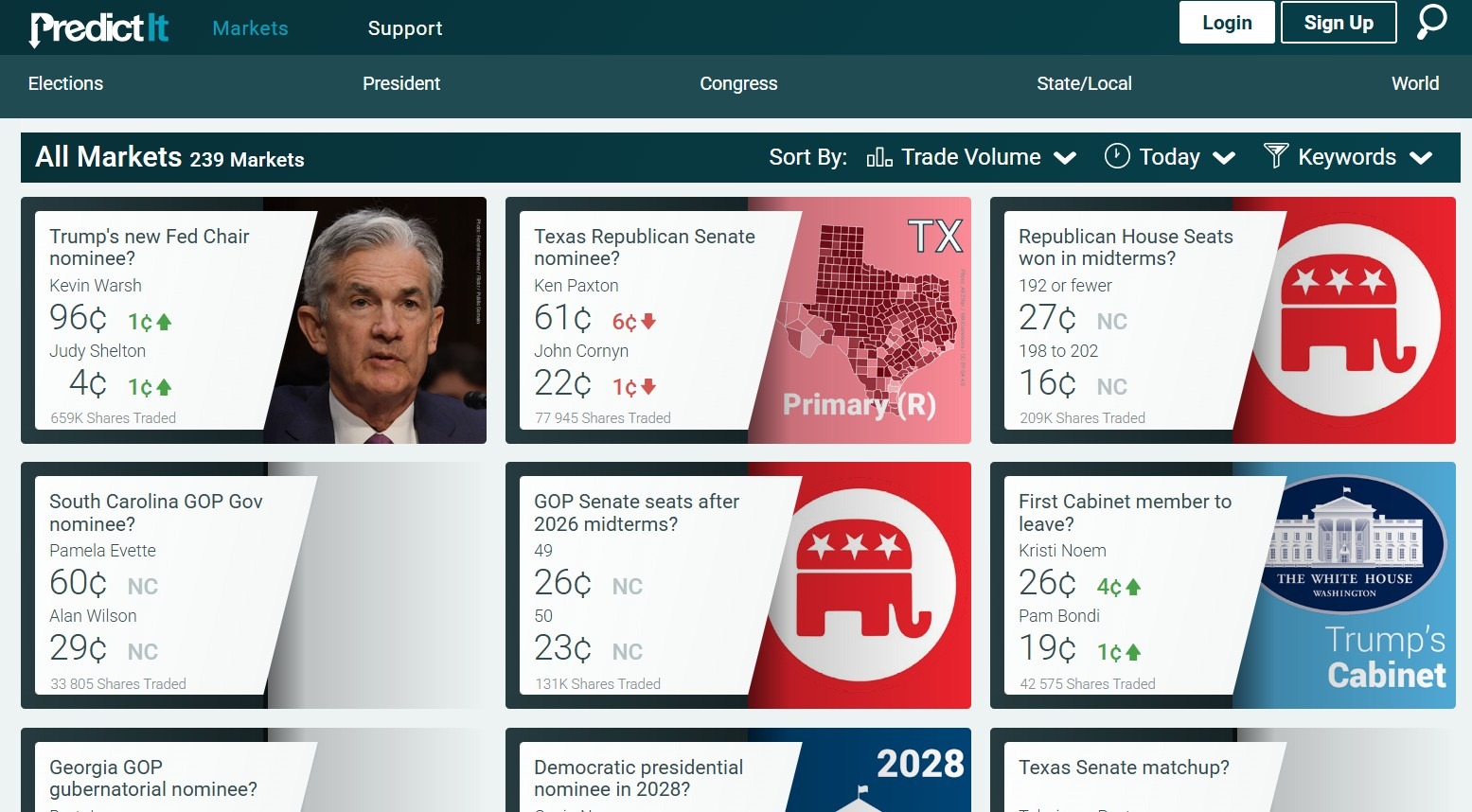

The shift we saw this month didn't happen in a vacuum. Throughout 2025, we saw platforms like Kalshi and Polymarket break into the mainstream, moving from niche crypto-adjacent sites to household names cited by major news networks. Google’s previous stance—treating prediction markets as unregulated gambling—simply couldn't hold up against the reality of CFTC-regulated exchanges and the sheer volume of users demanding "event contracts."

Previously, Google’s "Gambling and Games" policy was a catch-all that effectively banned anything that didn't have a specific state-issued sports betting license. The new framework creates a distinct category for "Event-Based Forecast Markets." This allows advertisers to target US audiences specifically for "non-sporting outcomes," provided they meet a rigorous set of criteria that separates legitimate exchanges from fly-by-night operations. It’s a sophisticated move that mirrors how Google handled the crypto exchange boom back in 2021—strict, but finally "open for business."

Why is this update highly newsworthy?

The timing of this update is what has every major agency in New York and London scrambling. We are currently looking at a massive convergence of high-volatility events—from the 2026 World Cup preparations to a particularly heated mid-term election cycle and unprecedented moves in the energy markets. Prediction markets have proven to be more accurate than traditional polling in many of these scenarios, making them a primary destination for high-value, data-driven users.

To give you an idea of the scale, look at the recent numbers from the late 2025 period:

-

Kalshi reported a 400% increase in active traders following their expanded legal clearances.

-

Polymarket’s "notional value" for non-political events surpassed $2 billion in a single quarter.

-

Search interest for "where to trade election contracts" hit an all-time high in the US during the November 2025 cycle.

By opening the gates now, Google is positioning itself to capture the massive ad spend that was previously being funneled into influencer marketing and "gray-market" organic SEO. For the first time, we can use the full power of Google’s Search and Display networks to put tradeable event contracts in front of the right eyes at the right time.

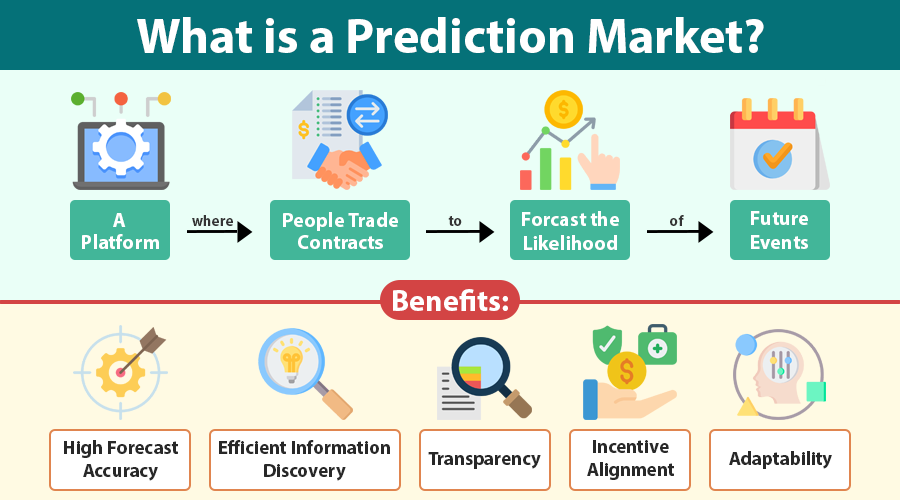

What Are Prediction Markets

Before we get into the weeds of the January 2026 policy, we need to be clear on what Google actually considers a "prediction market." If you’re coming from a sports betting background, you might think it’s just another way to set a line. It’s not. In the eyes of US regulators and Google’s compliance team, these are financial instruments first and foremost.

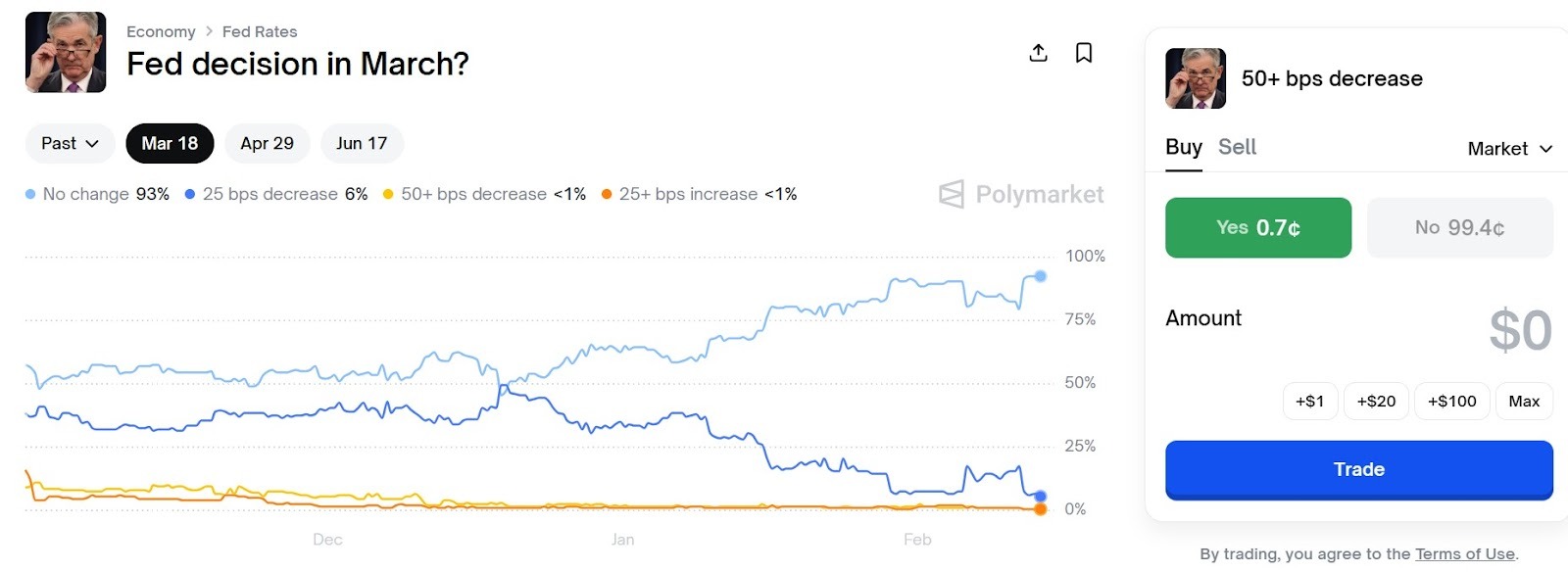

At their core, prediction markets are platforms where people trade shares based on the outcome of future events. If the event happens, the share pays out (usually at $1.00); if it doesn’t, it goes to zero. The price of the share at any given time represents the "crowd's" perceived probability of that event occurring. For example, if a share for "Will it rain in NYC on Christmas?" is trading at $0.65, the market is essentially saying there is a 65% chance of rain.

Definition and core mechanics

What makes these markets effective — and why they attract high-value traffic — is the collective intelligence factor. Unlike a bookie who sets a margin to ensure the house wins, a prediction market is a peer-to-peer exchange. It operates like the NYSE, but instead of trading Apple stock, you’re trading the likelihood of a Fed rate hike or the winner of a Best Picture Oscar.

The mechanics are surprisingly simple for the end-user:

-

Users buy "Yes" or "No" shares in a binary outcome.

-

The price fluctuates between $0.01 and $0.99 based on supply and demand.

-

The exchange takes a small transaction fee rather than a "vig" or "juice" on the odds.

-

Liquidity is provided by other traders or market makers, not a central house.

Take Kalshi, for instance. They are the first US-regulated exchange of this type. If you wanted to trade on whether the US will land a human on Mars by 2030, you aren’t "betting" in the traditional sense; you are buying an asset that reflects a specific forecast. This distinction is the bedrock of our Google Ads Guide for Prediction Markets, because it’s the legal "shield" we use to avoid being flagged as illegal gambling.

Real-money vs. play-money markets

This is where your campaign strategy will live or die. Google treats "play-money" platforms (like Manifold Markets) and "real-money" platforms (like Polymarket or Kalshi) very differently. Play-money sites are often categorized under "Social Gaming," which has a much lower barrier to entry for ads but lacks the high-intent, high-LTV (Lifetime Value) users that a real exchange attracts.

Real-money markets are the major leagues или high-stakes trading. When actual capital is at stake, the data becomes more accurate, and the users become much more sophisticated. For a media buyer, real-money prediction markets ads require a much higher level of verification. You aren't just selling a game; you’re asking people to deposit funds into a financial account.

Event contracts explained

In the world of US regulation, we don't call these "bets"—we call them event contracts. This is a specific legal term used by the CFTC (Commodity Futures Trading Commission). An event contract is a derivative. It’s a way for businesses to hedge against risks that traditional insurance won't touch.

Example: Growth Lead at a mid-sized logistics firm based in Long Beach used prediction markets to hedge against potential ILWU port strikes. By buying 'Yes' contracts for a work stoppage, they effectively insured their supply chain volatility. If the strike happened, their logistics costs would skyrocket, but their payout from the prediction market would offset those losses. This is the "utilitarian" side of the industry that Google is finally starting to embrace.

When you are running event contracts advertising, your messaging should often lean into this "hedging" or "data-driven" angle. Instead of "Win big on the election," the high-performing ads are now focusing on "Hedge your portfolio against political volatility." It’s cleaner, it’s more professional, and it passes the smell test for Google’s automated reviewers much faster.

Google Ads Policy Update (January 2026)

If you’ve been trying to run ads in this space before this year, you know the frustration of having your account flagged for "Gambling" or "Unreliable Financial Products" just for mentioning a forecast. The Google Ads policy update January 2026 is the official green light we’ve all been waiting for. It formally recognizes prediction markets as a distinct category under Financial Services, effectively pulling them out of the legal shadow lands they inhabited throughout 2024 and 2025.

This update isn't just a minor tweak to the wording; it is a fundamental reclassification. Google has finally synced its internal logic with the US Commodity Futures Trading Commission (CFTC), creating a narrow but clear path for US prediction market advertising. For the first time, the policy manual actually uses the term "Exchange-Listed Event Contracts," signaling that the platform now understands the difference between a shady offshore sportsbook and a regulated financial exchange.

What changed compared to 2025

Throughout 2025, prediction markets were essentially in a state of "unauthorized limbo." You could sometimes get away with running ads for informational blogs about the markets, but as soon as your landing page had a "Trade Now" button, the G2 Risk Solutions (formerly G2 Web Services) scanners would trigger a suspension. The logic back then was binary: if it looks like a bet, it’s gambling; if it looks like a stock, it’s an investment—and prediction markets didn't fit neatly into either box.

The January 21, 2026, policy shift changed three major things:

-

The "Gambling" Label: Prediction markets are no longer automatically bucketed with casinos and sportsbooks. They now live under the "Financial products and services" policy, which changes the type of license you need to show.

-

Geographic Specificity: While Google used to have a blanket global "shadow ban," this update explicitly opens the United States for business, provided the advertiser is federally authorized.

-

The Certification Gatekeeper: Google has introduced a specific "Prediction Market" certification. It’s no longer enough to have a general financial services checkmark; you need a specialized "passport" specifically for event contracts.

Newly allowed scenarios

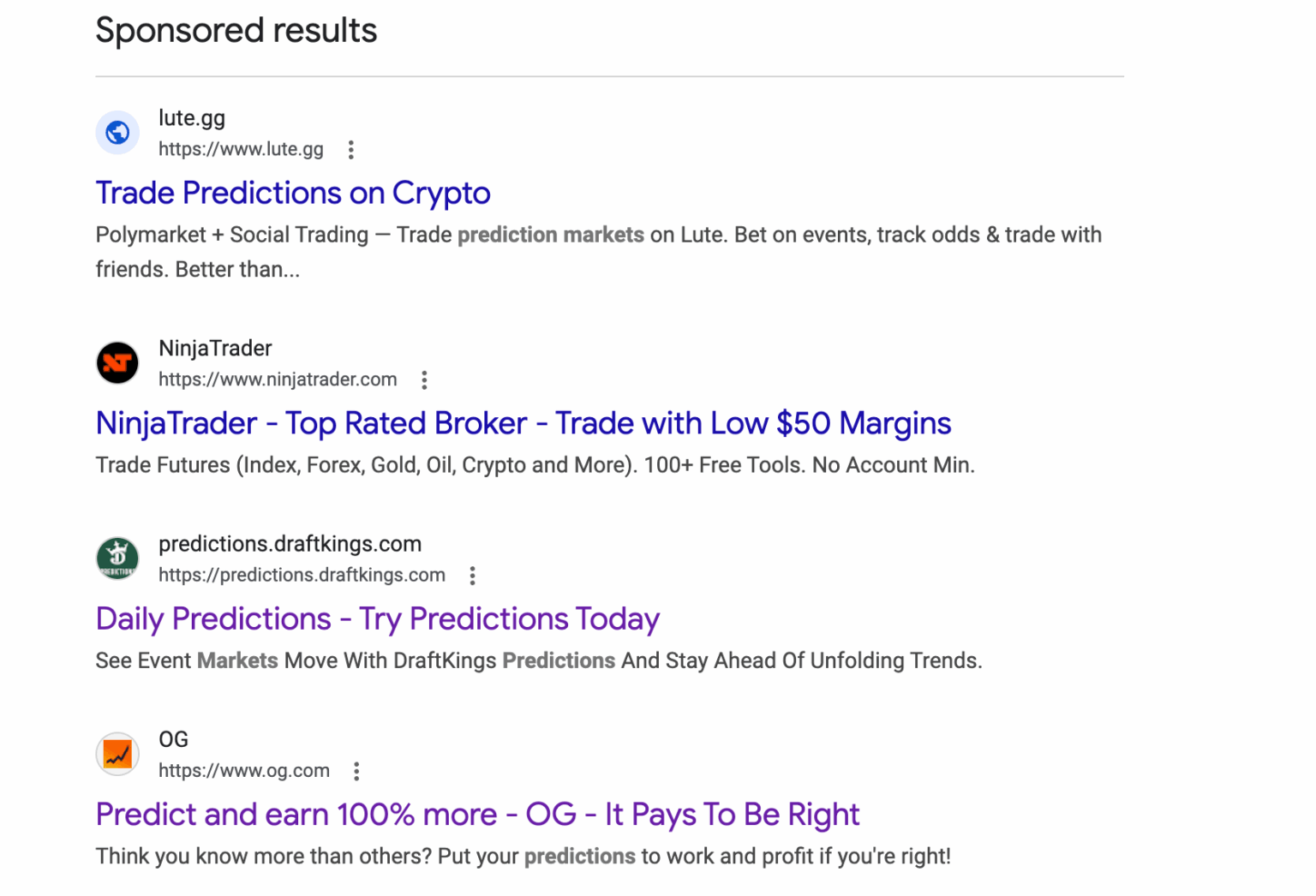

Under the new rules, the door is open for two specific types of players. First, we have the Designated Contract Markets (DCMs). These are platforms whose primary business is listing event-based contracts. If you are representing an exchange like Kalshi, you are now in the green. You can target the US market directly, using search queries related to economic forecasts, interest rates, or even sports outcomes, provided those outcomes are traded as regulated derivatives.

Second, NFA-registered brokerages are now allowed to play. If a brokerage provides third-party access to an approved DCM, they can now run regulated prediction markets ads. This is a huge win for retail trading apps that want to offer "Event Trading" as a feature alongside traditional stocks. We’re already seeing some major US fintech players prepping campaigns to capture users who want to "trade the headlines."

Explicit prohibitions

Don't mistake this for a free-for-all. Google has built a very high fence around this new pasture. Even with the update, several common scenarios will still get you banned instantly. The most important one is the Binary Options ban. Google is extremely careful to distinguish between a regulated event contract and a "fixed-return" binary option. If your platform offers "All or Nothing" payouts without the underlying structure of a CFTC-regulated exchange, you are still persona non grata.

Additionally, affiliates and signal providers are still strictly prohibited. This is a bit of a blow for the performance marketing community. Even if you are promoting a 100% legal, regulated exchange like Kalshi, you cannot run ads as a third-party affiliate. Google’s stance is that only the regulated entity (the exchange or the registered broker) can hold the "megaphone."

Finally, offshore exchanges remain blocked. If your platform is based in a jurisdiction like Curaçao or the Marshall Islands and doesn't hold a US federal license (CFTC or NFA), the prediction market compliance Google Ads system will reject your application. Google is acting as a second-layer regulator here, ensuring that only the "cleanest" players in the market get access to their search traffic.

Eligibility Requirements for Advertisers

Getting your policy certification in 2026 isn't a "set it and forget it" task. Google has essentially turned its verification process into a digital gauntlet. If you’re used to the simple identity verification where you just upload a passport and a utility bill, prepare for a reality check. For prediction market compliance Google Ads requires you to prove you are a legitimate financial player before you can even spend your first dollar.

Account and business verification

The first hurdle is the "Financial Services Verification." Google now partners with third-party vendors (like G2 Risk Solutions) to vet the underlying business. If you are targeting the US, the first thing they will ask for is your CFTC (Commodity Futures Trading Commission) registration number.

Real-life example: a fintech startup that tried to bypass this by registering as a "software provider" rather than an exchange. It didn't work. Google’s automated scanners and manual reviewers are now trained to look for any mention of "payouts," "contracts," or "market shares." If your business entity isn't authorized to handle derivatives or event contracts in the US, your application will be dead on arrival.

Key documents you’ll need on hand:

-

A valid CFTC or NFA (National Futures Association) membership ID.

-

Proof of physical business address in the US (P.O. boxes are a red flag and usually lead to instant rejection).

-

Articles of incorporation that match the legal name on your Google Ads payment profile exactly.

Landing page standards

In this Google Ads Guide for Prediction Markets, we cannot stress this enough: your landing page is your biggest liability. Google’s AI doesn't just look at your ad; it crawls your entire site to see if the "vibe" matches a regulated financial institution or a gambling den.

For the 2026 standards, a compliant landing page must avoid "adrenaline-fueled" imagery. If your hero section looks like a Las Vegas neon sign, you’re going to get flagged for gambling. Instead, the top-tier exchanges like Kalshi or Interactive Brokers use clean, data-heavy interfaces. Think candlesticks, order books, and probability percentages—not "Win Big!" banners.

Your site must also have a clear, easy-to-find "Terms of Service" and a "Conflict of Interest" policy. Because prediction markets are peer-to-peer, Google wants to see that you aren't "house-making" the odds in a way that disadvantages the user. Transparency is the name of the game.

Disclosure and disclaimer rules

This is the section where most agencies get lazy, and it’s why they get banned. You need a persistent, clear disclosure that trading event contracts involve risk. In 2026, the standard "Risk Warning" needs to be in a font size that is actually readable—usually no smaller than the main body text on your page.

Your footer must include:

-

A clear statement that these are "Event Contracts" regulated by the CFTC.

-

A geographic restriction notice (e.g., "Not available in certain states/jurisdictions").

-

A link to a "Responsible Trading" page—this is a new 2026 requirement that mirrors the "Responsible Gambling" links seen in sports betting ads.

A good example of this is the way PredictIt manages their disclaimers. They don't hide them in a tiny gray font at the bottom; they integrate the "educational" nature of the platform throughout the UI. Google loves this because it signals that you are focused on the "market" aspect rather than the "betting" aspect. If your disclaimers look like an afterthought, Google will treat your business like one.

Allowed and Restricted Ad Content

Getting your account certified is only half the battle. The real challenge for any Google Ads prediction markets strategist is keeping those ads running without triggering a "Misleading Representation" flag. Since the January 2026 update, Google’s reviewers (both the AI and the manual teams) have become hyper-sensitive to tone. They are looking for the sober language of Wall Street, not the hype of a sportsbook.

If you want to stay in the green, you have to treat your ad copy like a financial disclosure. The platforms that are winning right now aren't the ones shouting about "huge wins"—they are the ones positioning themselves as a smarter alternative to traditional polling or news.

Permitted messaging examples

The most successful campaigns right now lean heavily into the "utility" of the market. Google specifically looks for terms like "hedging," "forecasting," "contracts," and "market-implied probability." In fact, advertising event-based markets effectively means shifting your focus from the payout to the process.

Instead of saying "Bet on the Fed to raise rates," a compliant ad should say "Trade the Fed: Event contracts on the next interest rate decision." Notice the shift? You’re trading an asset based on a forecast, not placing a wager.

Examples of high-performing, compliant hooks:

-

"Hedge your portfolio against election volatility with regulated event contracts."

-

"What is the market saying about the next CPI release? Trade the forecast."

-

"Exchange-listed event contracts for industrial professionals: Hedge your energy risk."

-

"Access the world's most accurate crowdsourced data. Open a regulated trading account."

Look at the Kalshi "Super Bowl 2026" blitz as a prime case study. While traditional sportsbooks were burning hundreds of millions on "Risk-Free Bet" offers, Kalshi focused their messaging on being a "government-compliant exchange." They outspent DraftKings in certain digital segments by almost 35x during the 2025-2026 NFL season, largely because their "financial-first" messaging allowed them to bypass the restrictive "Gambling" filters that throttle traditional bookies. By framing the Super Bowl as an "event-based derivative" market, they achieved a peak of 150,000 downloads in a single weekend.

High-risk claims to avoid

The "red zone" for forecast markets ads policy is anything that sounds like a guaranteed return or low-risk speculation. Google’s 2026 algorithms are specifically tuned to catch "gambling-adjacent" language. If you use words like "jackpot," "odds," "bookie," or "winner," you’re basically asking for a manual review that you won't pass.

Claims that will get your account suspended in 2026:

-

"The easiest way to profit from the 2026 World Cup."

-

"Guaranteed payouts on political outcomes."

-

"Beat the house with our event trading signals."

-

"Start winning today—no financial experience required."

Example: a mid-tier exchange lost their certification because they ran a "Refer-a-Friend" promotion that promised "Free $50 to bet on anything." The word "bet" combined with a financial incentive triggered an automatic re-classification as "Unregulated Gambling," and it took them three weeks of appeals to get the ads back online. The lesson is simple: keep the incentives out of the headlines and keep the language technical.

Political and election-related limits

This is the trickiest part of the political prediction ads Google landscape. While prediction markets are often most popular during election cycles, Google has a separate "Election Integrity" policy that sits on top of the prediction market rules.

Even if you are a CFTC-regulated exchange, you cannot simply run ads saying "Who will win the midterms?" without being a Verified Election Advertiser. This requires a separate identity verification process where you must prove you are a US-based entity and disclose who is paying for the ads.

The 2026 rules for political contracts are strict:

-

You cannot target ads based on political affiliation (e.g., "People interested in the Democratic Party").

-

You cannot make claims that the market "decides" the election or can influence voter behavior.

-

In some states, like Nevada or Connecticut, you may be required to geo-exclude political contracts entirely due to local "gaming" conflicts, even if you have federal clearance.

An expert in the field, Tarek Mansour (CEO of Kalshi), has often noted that the value of these markets is in their "neutrality." If your ads start taking a "partisan" tone, you’re not just risking a Google ban; you’re risking a CFTC investigation. The smartest play for binary outcome markets advertising in politics is to focus on the "data visualization" aspect—showing the fluctuating probability charts rather than the candidates themselves.

Approval Process and Enforcement

Even if your paperwork is flawless, the actual journey from "Save Campaign" to "Eligible" in the Google Ads Guide for Prediction Markets is rarely a straight line. Google’s enforcement mechanism for high-stakes financial products is a two-tier system that combines aggressive AI scanning with a mandatory manual oversight layer. In early 2026, we’ve seen that the "learning phase" isn't just for your bidding strategy—it’s also for the compliance bots trying to figure out if you're a legitimate exchange or a clever workaround.

Review workflow

The moment you hit "Submit," your ad enters a black box. The first stage is a massive sweep by Google’s Large Language Models (LLMs), which scan your headlines, descriptions, and landing pages for prohibited keywords. If you pass this, your account is then cross-referenced with the financial prediction ads rules database to ensure your certification is active. For prediction markets, this initial phase usually takes about 24 to 48 hours, but for new accounts, it can stretch to a week.

Once the AI gives a green light, your first set of creatives is almost always sent for a manual spot-check. Google employs specialized financial compliance teams (often based in hubs like Austin or Dublin) who manually verify that your CFTC disclosures are visible and that your "Terms of Use" aren't hiding any predatory clauses. I’ve noticed that if you’re launching a high-spend campaign (over $5,000/day), this manual review happens much faster, as Google prioritizes high-value accounts that have already passed the initial "Trust" hurdles.

Common rejection reasons

The most common headache we see right now is the "Misleading Representation" flag. This usually happens when the ad copy promises a specific outcome or uses language that implies a "sure thing." Even if you are a legal prediction market promotion for a regulated entity, saying "The market predicts a 90% chance of X" can sometimes be interpreted by the AI as a claim of certainty.

Another frequent trap is the "Destination Mismatch." This occurs when your ad mentions one type of contract (e.g., "Trade Gold Prices"), but your landing page defaults to a different category (e.g., "Election Odds"). Google requires a one-to-one thematic match. If you’re using a single landing page for multiple ad groups, make sure the most prominent content on that page dynamically updates to reflect the ad's specific promise.

-

Incomplete or non-persistent risk disclosures in the footer.

-

Using "stock" images of money, coins, or luxury items that imply wealth creation.

-

Missing the "NFA Member" or "CFTC Regulated" badge on the landing page hero section.

-

Redirecting users to a mobile app store page that hasn't been individually certified.

Appeals and remediation

When the dreaded "Disapproved" status appears, the worst thing you can do is just "tweak and resubmit" without a plan. In 2026, Google’s "Strike" system is unforgiving. Three "Misleading Representation" strikes in 90 days can lead to a permanent account suspension. Instead, you need to use the "Appeal" function strategically. If you believe your ad is compliant, don't just click "I disagree with the decision"; upload a PDF brief that cites the specific section of the Google Ads Guide for Prediction Markets and includes your CFTC registration number.

A case study that perfectly illustrates this is from a boutique NYC-based forecasting firm, InsightMarkets. They had their entire election-cycle campaign blocked because their ad headlines used the phrase "Political Risk Hedging." Google's AI flagged it as "Sensitive Event" interference. Instead of deleting the ads, they filed an appeal with a letter from their legal counsel explaining how "Hedging" is a regulated financial activity, not a political statement. The appeal was granted in 48 hours, and they were able to capture 15% more market share while their competitors were still stuck in the "pending" queue.

The key to winning an appeal in this niche is to speak Google's language. If you can prove that your ad is helping the user manage risk rather than encouraging reckless speculation, you will almost always win the dispute. It’s about positioning yourself as a responsible partner in the financial ecosystem, not just another advertiser looking for clicks.

Compliance Checklist for 2026

Launching a campaign in this niche is less about "flipping a switch" and more about "passing an inspection." In 2026, the gap between a successful launch and a suspended account is often just a single missing disclaimer or an unverified business address. This checklist is designed to keep you on the right side of the forecast markets ads policy.

Pre-launch checklist

Before you even think about uploading your first set of assets, you need to ensure your foundation is ironclad. Google’s 2026 automated vetting process is faster and more aggressive than ever, and it won't give you a second chance if your documentation is out of order.

-

Federal Authorization: Confirm your status as a CFTC-authorized Designated Contract Market (DCM) or an NFA-registered brokerage. Have your registration IDs ready for the Google verification portal.

-

Account Certification: Apply for and receive the specific "Prediction Market" certification through the Google Ads Policy Manager. Do not start a campaign without this "green light" status.

-

Landing Page Hygiene: Ensure your landing page contains a prominent "Risk Warning" footer and a clear "Responsible Trading" link. Check that your physical US address is listed and matches your NFA/CFTC filings exactly.

-

Technical Exclusions: Set up geographic targeting to exclude states or countries where event-based trading is still prohibited. In the US, this often means checking specific state-level nuances for political contracts.

-

Ad Copy Audit: Review all headlines for "gambling-adjacent" language. Replace "bet," "wager," or "win" with "trade," "contract," or "forecast."

Ongoing monitoring checklist

A "clean" launch doesn't guarantee a clean flight. Prediction markets are highly volatile, and a news event that's legal to trade one day might be restricted the next. Your prediction market compliance Google Ads strategy must include a weekly audit of your active campaigns.

-

Creative Refresh: Monitor your "Policy Manager" tab for any new "Limited" or "Restricted" status updates. AI-driven policy shifts happen in real-time in 2026; what was approved on Monday could be flagged by Thursday.

-

Search Term Scrubbing: Check your Search Terms Report daily. Use negative keyword lists to exclude "junk" queries that might associate your platform with illegal sports betting or "get rich quick" schemes.

-

Disclosure Continuity: Periodically check that your site’s footers and disclaimers are loading correctly on both mobile and desktop. A broken CSS file that hides your risk warning is a valid reason for a total account suspension.

-

Smart Bidding Oversight: Ensure your automated bidding strategies aren't over-allocating budget to "low-trust" placements. Even if Google’s AI thinks a placement is high-converting, if it violates your brand safety or compliance rules, you must exclude it manually.

To truly master the Google Ads prediction markets landscape, you have to understand how it sits relative to its "neighbors"—iGaming (gambling) and traditional financial trading. In the eyes of a Google policy reviewer, these three niches are a Venn diagram with very sharp edges. If you accidentally drift from the "Prediction Market" circle into the "Gambling" circle, your account won't just be restricted; it will be nuked for trying to circumvent the more expensive and difficult-to-attain gambling licenses.

Prediction markets vs. iGaming

The biggest point of confusion for new advertisers is the overlap between sports-based event contracts and traditional sports betting. On the surface, they look identical: you’re putting money down on the outcome of a game. However, the regulatory and advertising frameworks couldn't be more different.

Traditional iGaming is regulated on a state-by-state basis. To run ads for a sportsbook like FanDuel or DraftKings, you need a license in every single state you target. This creates a massive "compliance patchwork" that requires a legal team just to manage your geo-targeting. Prediction markets, however, operate under federal CFTC jurisdiction. This means that a certified exchange like Kalshi can technically run ads nationally (with a few exceptions like Nevada), effectively "leapfrogging" the state-level barriers that hold back traditional gambling brands.

As Thomas Ives, co-founder of RAAS Lab, recently pointed out, prediction markets are often perceived as a "cleaner alternative" to gambling. Because they fall under financial services, the ad inventory available is much broader and often cheaper than the "adult-only" segments reserved for casinos.

Prediction markets vs. financial trading

If iGaming is the rowdy cousin, traditional financial trading (stocks, forex, commodities) is the older sibling. Google’s 2026 policy treats prediction markets as a derivative of this world. The mechanics—order books, limit orders, and bid-ask spreads—are exactly the same as what you’d find on E*TRADE or Charles Schwab.

The critical difference lies in the underlying asset. In traditional trading, you own a share of a company or a physical barrel of oil. In prediction markets, you own a contract tied to a specific truth. This makes the "Discovery" phase of Google Ads prediction markets campaigns much more diverse. While a stock trader might search for "Nvidia earnings," a prediction market trader might search for "Will Nvidia announce a 2-for-1 split by June?"

A Case Study in Divergence:

In late 2025, a fintech platform attempted to run ads for "Binary Outcome Stocks." They tried to blend the two niches to capture both audiences. Google rejected the campaign within hours. Why? Because the landing page used "Market Analysis" terminology (financial) but the product offered "fixed-odds payouts" (which Google still classifies as prohibited Binary Options). The lesson: if you want to be treated like a financial trader, you must maintain the structure of an exchange where prices are determined by the users, not the house.

Experts like Vitalik Buterin have argued that prediction markets are actually "healthier" than stocks because they provide a direct incentive for accuracy over hype. When you advertise these markets, you are essentially selling information—and that is a much easier sell to Google’s compliance team than "wealth creation."

Key Risks and Future Outlook

While the Google Ads policy update January 2026 feels like a "mission accomplished" moment, we are actually just at the beginning of a long-term regulatory cycle. If you are planning your budget for the rest of 2026 and into 2027, you need to understand that Google’s current "permissive" stance is a test. They are watching how the market behaves, how users react to financial-hybrid products, and—most importantly—how the regulators react to Google.

Enforcement trends

The biggest trend we are seeing right now is Automated Real-Time Auditing. Gone are the days when you could wait for a manual reviewer to catch a policy violation. In 2026, Google has integrated services like G2 Risk Solutions directly into the ad auction. This means your backend data—including your NFA or CFTC standing—is being pinged in real-time. If an exchange’s license is paused at 10:00 AM, the prediction market compliance Google Ads system will pull their ads by 10:05 AM.

We are also seeing a shift toward "Sentiment-Based Filtering." Google’s AI is getting better at distinguishing between an ad that promotes "informed hedging" and one that promotes "addictive speculation." Campaigns that lean too hard into the "thrill" of the trade are seeing higher CPCs (Cost-Per-Clicks) as a "soft penalty," even if they aren't technically disapproved.

Expected policy evolution

Looking ahead to 2027, experts predict that Google will expand the "Prediction Market" category beyond the United States. We’re already seeing early discussions in the UK and parts of the EU about adopting a similar "Financial Derivative" framework for event contracts. However, the tradeoff for this expansion will likely be even stricter disclosure and disclaimer rules.

Expect to see:

-

Mandatory "Accuracy Ratings": Google may eventually require platforms to display their historical forecasting accuracy on their landing pages—similar to how investment funds must show past performance.

-

Tighter Political Windows: During major elections, Google might implement a "Cooling Off" period where all political event contract ads are paused 48 hours before the polls open to prevent last-minute market manipulation.

-

Affiliate Re-entry (with a catch): There is a rumor that Google may allow affiliates back into the space by 2027, but only if those affiliates hold their own individual "Financial Lead Generator" licenses, similar to the requirements in the UK's FCA regulations.

Conclusion

The window of opportunity for Google Ads prediction markets is officially open, but it’s a window with very specific dimensions. The January 2026 update has effectively "professionalized" the niche, moving it from the fringes of the affiliate world into the heart of the fintech sector.

Success in this new era isn't about finding a clever workaround; it's about leaning into the regulations. If you treat your platform like a serious financial exchange—with the documentation, language, and transparency to match—you can finally access the massive, high-intent traffic that Google Search has to offer. The "Wild West" days are over, but for those who can navigate the new rules, the real growth is just beginning.

FAQs

Are prediction markets allowed in Google Ads in 2026?

Starting January 21, 2026, Google officially permits ads for prediction markets. Google defines these as platforms that facilitate the listing of or provide customer access to Exchange-Listed Event Contracts related to economics, sports, or current events.

Does Google Ads allow real-money prediction market advertising in the US?

Yes, but with strict limitations. Real-money advertising is allowed only in the United States and only for platforms that are federally regulated. Google has specifically excluded other regions for now, and it explicitly prohibits "offshore" or unregulated exchanges. Furthermore, Nevada is currently excluded from this policy due to ongoing state-level legal disputes.

What regulator oversees prediction markets advertised on Google?

For an advertiser to be eligible, they must be overseen by federal commodities regulators:

-

CFTC (Commodity Futures Trading Commission): Platforms must be authorized as a Designated Contract Market (DCM).

-

NFA (National Futures Association): Brokerages must be registered with the NFA to provide third-party access to DCM-listed products.

Why are some prediction market ads rejected by Google?

Even if you are a regulated exchange, Google may reject ads for several common reasons:

-

Binary Options & Fixed Returns: Google still maintains a global ban on binary options. If your "event contract" looks like a fixed-odds "all-or-nothing" bet without an underlying exchange structure, it will be rejected.

-

Affiliate & Signal Content: Google prohibits ads from affiliates, "tipsters," or sites offering trading signals/guidance. Only the regulated exchange or registered broker can run the ads.

-

Informational/Educational Blogs: Sites that only provide analysis without being the authorized trading platform are generally barred from this specific certification.

-

Geographic Violations: Targeting states where the platform is not authorized (like Nevada) or trying to target users outside the US will trigger a rejection.

How can advertisers comply with Google Ads prediction market rules?

To run ads successfully in 2026, you must follow a rigid compliance path:

-

Obtain Federal Licensing: Ensure your business is a CFTC-authorized DCM or an NFA-registered broker.

-

Apply for Google Certification: You must submit a specific application to Google for "Prediction Market" certification. This is separate from standard identity verification.

-

Audit Landing Pages: Your site must have clear risk disclosures, evidence of regulation, and no "gambling" language (e.g., use "Trade" instead of "Bet").

-

Targeting Precision: Set your campaign targeting exclusively to the United States (excluding prohibited states) and ensure your ads do not appeal to minors.